This is important, considering Georgia’s neighbors are either income tax-free or already have a lower rate. On the one hand, a statewide flat tax will make Georgia a more tax-friendly state for both residents and businesses. There are pros and cons to this approach. The deduction for dependents will be $3,000. Single filers can claim a deduction of $12,000. Changes will take effect beginning on January 1, 2024. 1437 also increases the personal exemption amounts. Change to Georgia Personal Exemption Amounts And according to the Tax Foundation, one of 16 other states implementing tax reform in the past 18 months.

Georgia 2020 tax tables code#

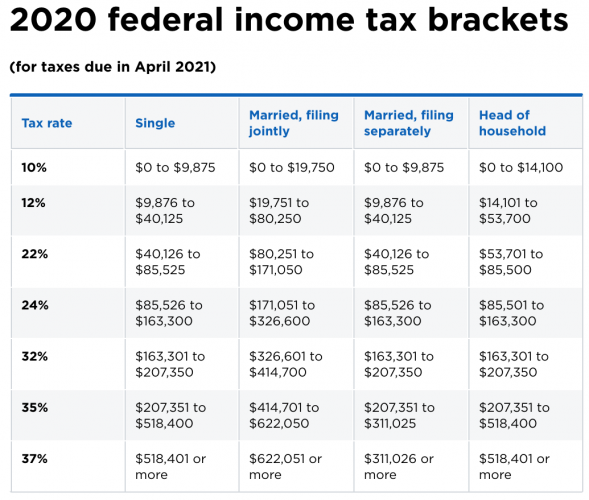

Georgia now joins Iowa and Mississippi as the third state this year to amend its tax code for a flat rate. So much so that most resident taxpayers are getting an extra, automatic refund. Since then, Georgia’s economy has fared well. Another vote was supposed to happen in 2020 that would again lower the top rate to 5.5 percent, but it was delayed due to the pandemic. As recently as 2018, state legislators voted to lower the top income tax rate from six percent to 5.75 percent.

To help clients, prospects, and others, Wilson Lewis has provided a summary of the key details below. The change is set to be phased in over a several year period beginning in 2024. The good news is such an effort is currently underway in Georgia as Governor Kemp recently signed legislation that introduced a new flat tax rate. However, significant savings can arise when significant changes to tax regulations are made as part of a tax reform effort. After all, the government relies on tax revenue to provide services and to make investments in community and other programs.

While tax planning is a useful process, it can be difficult to find significant savings each year. Although these activities are most common at year-end, many will make it a regular focus throughout the year. Tax planning focuses on reviewing tax law changes, updates to incentives and deductions, and other changes in areas where savings may be present. Many Atlanta families and high net worth individuals invest significant time uncovering strategies designed to limit federal and state income taxes due.

0 kommentar(er)

0 kommentar(er)